View the SARS Refund information here: When will SARS Pay My Tax Refund? How Can I Get a South African Tax Refund? from this piece. A few SARS refund-related details: When will SARS pay my tax refund? How Can I Get a South African Tax Refund? and further pertinent data are contained in this article.

SARS Refund

A lot of people file their forms and pay their taxes. The South African Revenue Service (SARS) is responsible for handling returns, refunds, and other pertinent matters in South Africa. When someone overpays taxes to the government, they typically anticipate receiving a return.

In this instance, the qualified taxpayers receive their reimbursements from SARS once their returns have been processed. Through the Auto-Assessment, you can find out more about the refunds.

SARS Refund Overview

When will SARS Pay My Tax Refund?

Depending on how much a person has paid and how much they still owe, SARS reimburses the refund. On the other hand, if someone underpays taxes, they still owe the SARS the remaining amount.

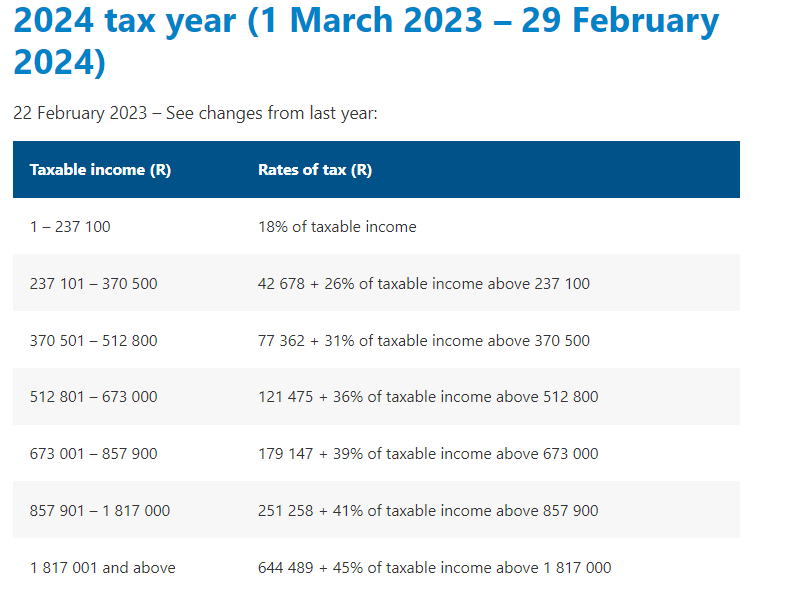

On the taxable income, income tax is paid. These may consist of earnings from a job, profits from rentals, pensions, annuities, etc. Beginning on March 1, 2023, and ending on February 29, 2024, is the current tax year, or 2024.

The finance minister of South Africa modifies the country’s tax bands annually. The parliament then approves and puts these modifications into effect for a specific fiscal year.

Given the constant changes in these factors, it is critical for individuals to be aware of their required payment amounts depending on their tax bracket and rate. This may result in paying too much or too little. Even if refunds are given for overpayments, the procedure may take some time.

The SARS issues online refunds seventy-two hours after the assessment. People should make sure their banking information is accurate in order for the refunds to be processed promptly and deposited into the appropriate bank account. The evaluation is accessible through the SARS mobile application or the eFiling portal.

The assessment tells you if someone owes taxes or if they should get a refund. A person can anticipate receiving their refund money between 72 hours of receiving an evaluation and the time when it is due.

If they have any unpaid taxes, they must make the necessary payment by the deadline. October 23 was the deadline for the 2024 tax year. You can consult the official SARS website for more details on the assessment, tax rates, tax year, and other pertinent matters.

Why is the SARS Refund Delayed?

Please be aware that only those who have properly filed their tax returns will receive refunds from SARS. The SARS checks the tax returns and financial information after they are filed. The verification procedure may take up to 21 days.

The date of the supporting document submission is when the 21 days are measured. The SARS frequently requests supporting documentation from taxpayers. These records assist them in determining a person’s eligibility for a refund.

If a taxpayer fails to provide the necessary documentation on time, provides inadequate evidence, provides inaccurate banking information, etc., the refund may be delayed.

Once the necessary documentation is supplied, it could take up to 90 days for audit verification to occur if an individual has filed returns for several years.

A refund won’t be given to someone who has unpaid returns until they pay for them. In certain cases, the required amount is subtracted from the anticipated refund in order to pay off the remaining obligation. The reimbursement amount is lower than anticipated for this reason.

How to Get Tax Refund in South Africa?

In South Africa, individuals must ensure that their tax returns are filed on time in order to get refunds. When the SARS requests certain documents, they should also make sure they have all the required paperwork on hand.

Furthermore, the bank information provided with the SARS must be accurate. The money may not be transferred at all or may be sent into the incorrect account if the information is not updated in a timely manner. If a person has not got their refund in the anticipated period, they ought to get in touch with SARS.

ITG residence