As retirement approaches, navigating the complexities of taxes and allowances becomes crucial for pensioners in Ireland. In this comprehensive guide, we delve into the intricacies of the Tax Free Allowance Ireland offers to pensioners, shedding light on eligibility criteria, pension systems, tax exemption limits, and more. Let’s embark on a journey to demystify the realm of tax allowances for Ireland’s senior citizens.

Tax Free Allowance Ireland for Pensioners

Pensions in Ireland are subject to taxation, but certain allowances provide relief to pensioners. Individuals aged below 65 are exempt from paying taxes up to a certain income threshold. Moreover, if the individual’s legal partner is above 65 and they file taxes jointly, they may also benefit from tax-free allowances. This provision aims to alleviate financial burdens, especially for those navigating the challenges of retirement.

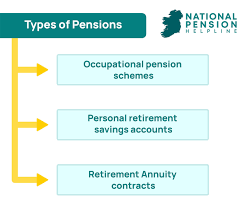

Pension System in Ireland

Understanding the pension system is paramount for pensioners to maximize their benefits. Ireland offers two main types of state pensions: contributory and non-contributory.

- Contributory Pension: Workers actively contribute to this pension during their employment years, ensuring a steady income upon retirement. The Full State Pension is independent of annual income and provides additional income support. Currently, the Contributory Pension Rate stands at €248.60 per week.

- Non-Contributory Pension: Designed for individuals who haven’t made contributions to PRSI, this pension provides basic financial support. The payment is means-tested and amounts to €266 per week.

Tax Exemption Limits in Ireland

Tax exemption limits vary based on marital status and number of dependents. Here’s a breakdown:

- For Solo, Widow, or Surviving Civil Partner: €18,000

- For Married and Legal Couples: €36,000

- Per Child: €575 for the first child, €830 for subsequent children

Additional marginal relief is available for individuals exceeding these limits, providing further support for pensioners.

Who Can Get Tax Free Allowance?

To avail of Tax Free Allowance, pensioners must meet specific eligibility criteria:

- The claimant must be an Irish citizen or permanent visa holder.

- The individual must be at least 65 years old.

- Tax must be paid jointly or separately on the annual income.

Age Tax Credit, a common relief for pensioners, offers varying amounts based on different categories, providing additional financial support.

Read more:

- Biden Re-Election impacting Stimulus Checks: Your Wallet’s Fate Hangs in the Balance!

- Texas Lawmaker Sparks Outrage Over Stimulus Check Controversy

All You Should Know

Understanding the various tax credits and reliefs available is essential for pensioners to optimize their tax liabilities:

- Personal Tax Credit: Each adult in a family can claim €1,650.

- Children’s Tax Credit: Parents receive €1,200 for each child below 12 years.

- Carer’s Tax Credit: Legal caregivers can claim €1,000 for providing at least 10 hours of care per week.

These credits reduce taxable income, resulting in lower income tax payments. Moreover, Home Nursing tax relief is available for elderly individuals requiring caregiver support due to physical illness.

In conclusion, navigating the Tax Free Allowance Ireland provides for pensioners requires understanding eligibility criteria, pension systems, tax exemption limits, and available reliefs and credits. By staying informed and leveraging available resources, pensioners can maximize their financial well-being during retirement.

The original article can be read on www.incometaxgujarat.org